Getting My Investment Consultant To Work

Getting My Investment Consultant To Work

Blog Article

Ia Wealth Management for Dummies

Table of ContentsTax Planning copyright Fundamentals ExplainedAbout Tax Planning copyrightExamine This Report about Tax Planning copyrightIndicators on Retirement Planning copyright You Need To KnowInvestment Representative for DummiesFacts About Independent Investment Advisor copyright Uncovered

“If you're purchasing a product or service, state a television or a pc, you might wish to know the requirements of itwhat are the elements and what it can perform,” Purda details. “You can contemplate purchasing monetary guidance and assistance in the same manner. Men And Women have to know what they're getting.” With monetary guidance, it’s important to remember that this product isn’t securities, stocks and other assets.It’s such things as budgeting, planning retirement or reducing financial obligation. And like purchasing a computer from a reliable company, people need to know these include buying economic advice from a reliable professional. Among Purda and Ashworth’s most interesting findings is approximately the fees that economic coordinators charge their customers.

This held genuine regardless the cost structurehourly, commission, assets under management or flat rate (inside research, the dollar worth of charges was equivalent in each case). “It however boils down to the worthiness idea and anxiety on buyers’ component which they don’t determine what they're getting in change of these costs,” states Purda.

Some Ideas on Investment Representative You Need To Know

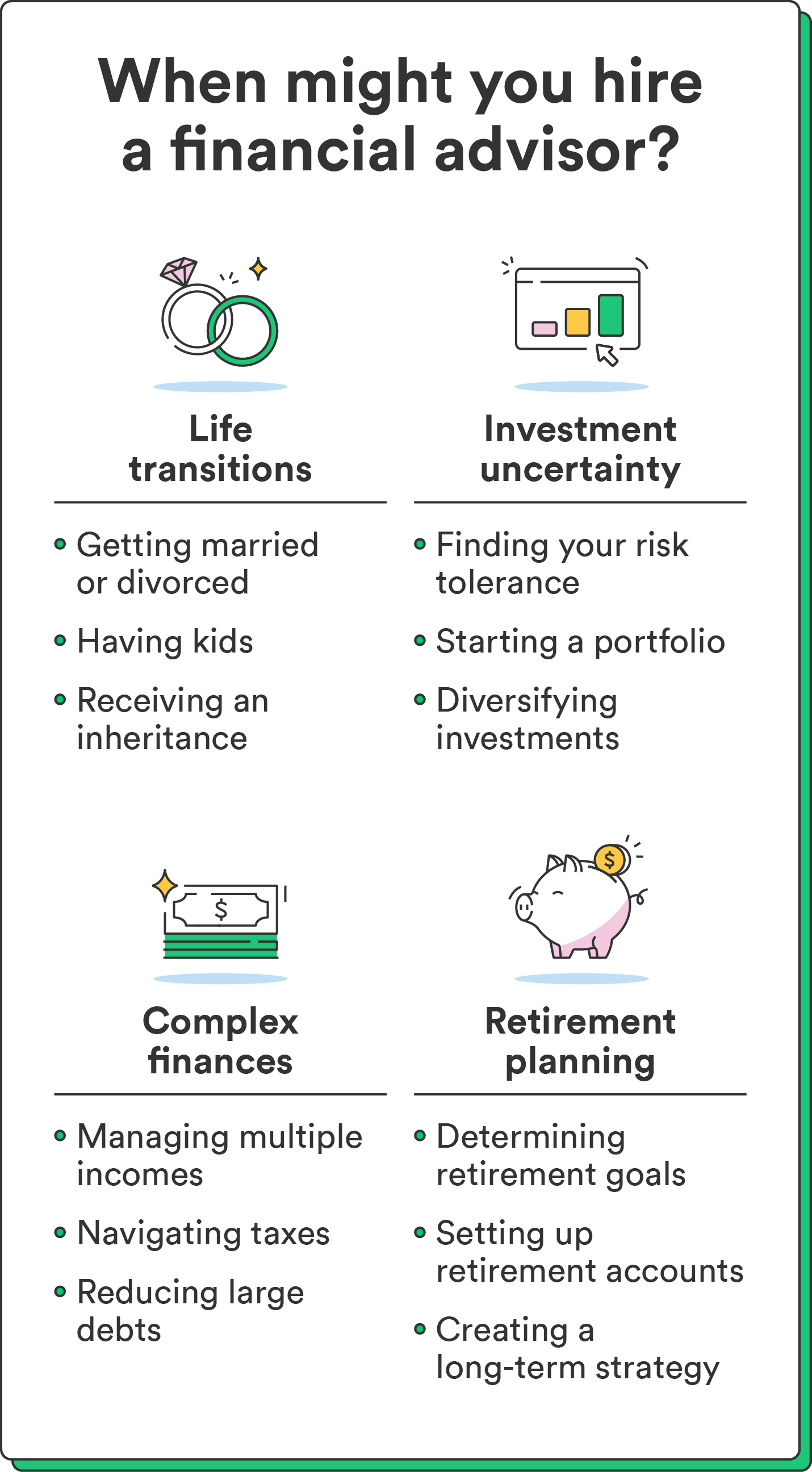

Pay attention to this article once you notice the word economic expert, exactly what comes to mind? Many people remember an expert who are able to give them financial advice, particularly when you are looking at trading. That’s a good starting point, although it doesn’t paint the complete image. Not really close! Economic advisors will individuals with a lot of some other money goals as well.

An economic consultant will allow you to build wide range and shield it when it comes to overall. They can estimate your own future financial requirements and plan how to stretch the pension savings. They can in addition counsel you on when to begin experiencing Social protection and using the income in your retirement accounts so you can abstain from any horrible charges.

Examine This Report on Investment Representative

They can assist you to figure out exactly what mutual resources are best for your needs and demonstrate tips control and work out by far the most of your assets. They can also support see the threats and what you’ll have to do to produce your goals. A practiced investment professional will also help you stick to the roller coaster of investingeven as soon as your financial investments get a dive.

Capable provide you with the assistance you need to produce a strategy to make fully sure your desires are carried out. While can’t place a price label regarding assurance that accompany that. Per research conducted recently, an average 65-year-old few in 2022 needs to have around $315,000 saved to pay for medical care prices in your retirement.

How Tax Planning copyright can Save You Time, Stress, and Money.

Since we’ve reviewed exactly what economic experts perform, let’s dig to the varieties. Here’s a great rule of thumb: All financial coordinators tend to be economic advisors, although not all advisors tend to be planners - https://www.startus.cc/company/647135. A financial planner focuses primarily on assisting men and women develop intentions to achieve lasting goalsthings like beginning a college investment or saving for a down payment on a home

How do you understand which economic advisor suits you - https://www.cybo.com/CA-biz/lighthouse-wealth-management_50? Check out things to do to ensure you are really choosing suitable person. What do you do when you have two terrible choices to select from? Simple! Find even more possibilities. The greater options you have, the much more likely you happen to be in order to make good choice

The Of Private Wealth Management copyright

All of our wise, Vestor plan causes it to be possible for you by revealing you up to five financial advisors who can serve you. The good thing is actually, it's free to obtain regarding an advisor! And don’t forget to get to the interview ready with a list of concerns to inquire about to help you find out if they’re a good fit.

But listen, even though a specialist is actually smarter than the normal keep doesn’t provide them with the right to reveal what to do. Often, analysts are full of by themselves because they have more levels than a thermometer. If an advisor starts talking-down to you personally, it’s time and energy to show them the entranceway.

Keep in mind that! It’s important that you plus economic advisor (anyone who it eventually ends up getting) are on alike page. You want an expert who's a long-lasting investing strategysomeone who’ll motivate you to keep spending regularly whether the market is upwards or down. investment consultant. In addition don’t like to make use of an individual who pushes one to invest in something which’s also high-risk or you are not comfortable with

Tax Planning copyright Fundamentals Explained

That combine gives you the diversity you'll want to Our site successfully spend for the longterm. Because research monetary advisors, you’ll most likely encounter the definition of fiduciary duty. All this work indicates is actually any expert you employ needs to work in a fashion that benefits their customer rather than their self-interest.

Report this page